Take note which the borrower will need to have sufficient equity in their house to be qualified for a reverse mortgage loan. The loan mustalso be for your borrower’s Major residence, and also the borrower need to undergo a economic assessment to qualify for your reverse mortgage loan.

The good news is, the worries that senior borrowers sometimes facial area even though searching for a property finance loan don’t allow it to be impossible to obtain a person. To qualify for a house loan like a senior or retired borrower, you’ll need to provide documentation that serves as proof of income.

Nevertheless, Doing the job not easy to pay off your home finance loan financial debt ahead of retirement may not be the top system possibly. It could depart you economically vulnerable and not able to buy emergencies.

Knowledge the Loan-to-Worth (LTV) Ratio Determining an LTV ratio can be a vital element of home loan underwriting. It may be Utilized in the process of purchasing a residence, refinancing a current house loan into a new loan, or borrowing versus gathered equity inside a assets.

Copies of reward verification, evidence of profits or evidence of award letter, statements and/or tax returns

Relocating to a brand new place: In keeping with a person study, as quite a few as forty% of retirees are venturing out of their house state on the lookout for improved weather conditions, recreation, favorable taxes, and other Gains

Bankrate’s editorial staff writes on behalf of YOU – the reader. Our intention is always to give you the very best information that may help you make wise individual finance conclusions. We follow strict rules making sure that our editorial articles just isn't influenced by advertisers.

Make sure to look at your partner or associate when determining to acquire a mortgage. What would materialize if among you have been to die, and how would that impact the survivor’s ability to repay the loan?

Many people decide to refinance their FHA loans as soon as their LTV ratio reaches eighty% to be able to eliminate the MIP need.

one. No standard revenue Mortgage organizations must verify that you can repay a home loan. Commonly, Which means thinking about monthly revenue depending on W2 tax varieties. But most seniors gained’t have an everyday month to month money circulation here to point out lenders.

Paying down your loan’s principal equilibrium may also lower your LTV. And if your property boosts in benefit, that will reduce your LTV, also.

Social Security money is appropriate for Assembly the loan’s money needs, which makes it a viable selection for retired armed forces personnel.

S. bank. Separately, 6 other sector bankers and traders mentioned the offers were the main these kinds of transactions they'd noticed Because the crisis to redistribute hazard that experienced by now been offered as soon as.

Likewise, Freddie Mac improved its lending suggestions to really make it much easier for borrowers to qualify to get a house loan with confined income, but substantial property.

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Hallie Eisenberg Then & Now!

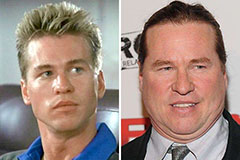

Hallie Eisenberg Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!